In the dynamic world of digital assets, crypto trading bots have emerged as indispensable tools for both novice and experienced investors. These sophisticated software programs automate trading strategies, executing buy and sell orders based on predefined parameters and market conditions. They promise to remove emotional biases, enhance efficiency, and capitalize on opportunities around the clock. Understanding their functionality is key to navigating the fast-paced cryptocurrency market effectively.

Contents

What Are Crypto Trading Bots and How Do They Work?

What Are Crypto Trading Bots?

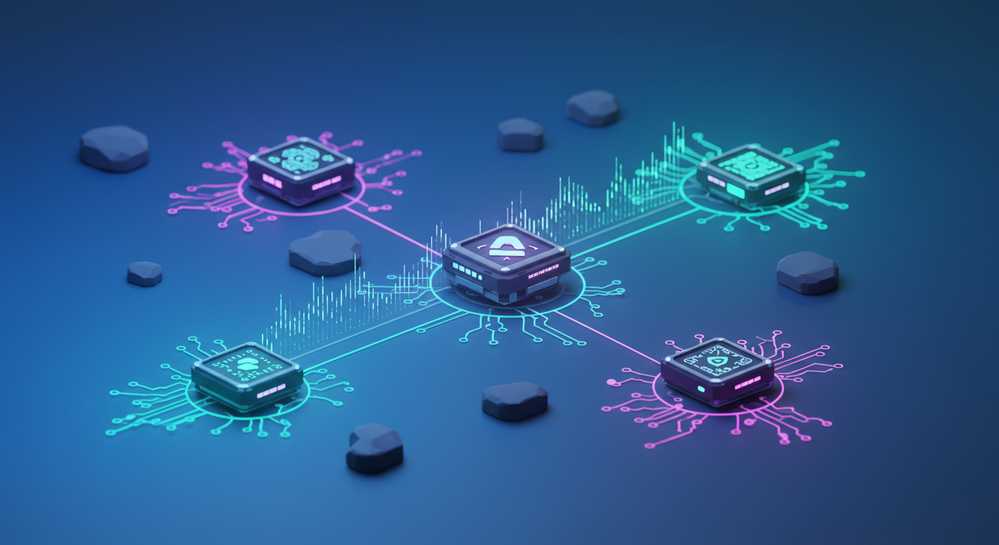

Crypto trading bots are sophisticated software applications designed to automate cryptocurrency transactions. They connect directly to exchanges using secure Application Programming Interfaces (APIs), executing trades based on predefined rules. This automation allows for continuous market monitoring and high-frequency trading, capabilities beyond human capacity, ensuring timely execution in volatile markets.

Core Mechanics of Automated Trading

These bots operate by meticulously analyzing vast amounts of market data, including real-time price movements, trading volumes, and order book information. When specific, pre-set conditions are met, the bot instantly places buy or sell orders. This eliminates emotional biases and ensures rapid, disciplined execution of strategies, crucial for capitalizing on fleeting opportunities.

The operational framework relies on three key pillars:

- API Connection: Bots establish a secure link with cryptocurrency exchanges, enabling them to read live market data and submit trade orders without manual intervention.

- Predefined Strategies: Users configure bots with specific trading algorithms. These strategies dictate when to buy or sell, based on technical indicators or market events.

- 24/7 Monitoring: Unlike human traders, bots operate around the clock. They continuously scan the market for opportunities, reacting instantly to price changes or emerging trends. For advanced automation, consider exploring AI crypto trading bots.

Key Advantages of Using Trading Bots

Eliminating Emotional Biases with Crypto Trading Bots

Leveraging crypto trading bots significantly enhances a trader’s performance in the volatile digital asset market. One primary benefit is the complete removal of emotional decision-making. Human traders often succumb to fear or greed, leading to impulsive and suboptimal trades. Bots, however, strictly adhere to their programmed logic, ensuring disciplined execution regardless of market sentiment. This consistency is vital for long-term success.

Enhanced Efficiency and Speed

Bots process vast market data and execute trades far quicker than any human. This speed is critical for capturing fleeting arbitrage opportunities or reacting instantly to rapid price shifts. Optimal entry and exit points are secured, maximizing potential gains in fast-moving crypto markets. Such efficiency is unattainable with manual trading, providing a distinct competitive edge.

Continuous Market Presence and Risk Management

The cryptocurrency market operates 24/7, and crypto trading bots never sleep. They continuously monitor for opportunities, allowing users to capitalize on market movements at any hour. Furthermore, bots can implement sophisticated risk management strategies, such as automatic stop-loss orders and profit targets. This protects capital effectively and helps maintain a balanced portfolio, even during extreme volatility.

Popular Strategies and Types of Crypto Trading Bots

The effectiveness of any crypto trading bot depends heavily on its chosen strategy. Different market conditions favor distinct automated approaches. Understanding these popular strategies is crucial for maximizing your trading potential.

Grid Trading Bots for Volatility

Grid bots excel in sideways markets by placing buy and sell orders at set intervals. They profit from continuous “buy low, sell high” within a defined price range. This strategy capitalizes on market oscillations, ideal for non-trending assets.

Arbitrage Bots: Price Discrepancy Exploitation

Arbitrage bots exploit temporary price differences for the same asset across exchanges. They swiftly buy where it’s cheaper and sell where it’s pricier, securing instant profit. Rapid execution is critical as opportunities vanish quickly.

DCA Bots for Steady Accumulation

Dollar-Cost Averaging (DCA) bots systematically invest a fixed amount at regular intervals, irrespective of price. This reduces the average cost per unit over time, mitigating volatility risks. It’s ideal for long-term accumulation.

Market Making Bots: Liquidity Providers

Market making bots enhance liquidity by placing simultaneous buy and sell orders near the current price. They profit from the bid-ask spread on each executed trade. These bots are vital for market depth and efficient trading.

Setting Up and Optimizing Your Trading Bot

Successfully deploying crypto trading bots demands careful planning and continuous optimization. This maximizes potential while effectively managing risks. The setup process involves several critical steps.

Choosing the Right Bot and Exchange

First, select a reputable bot platform and a compatible exchange. Research various crypto trading bots, evaluating strategies, pricing, and security. High liquidity and a robust API are essential for smooth integration. User reviews offer valuable insights.

Configuration and Backtesting

Configure your bot with a specific strategy, setting parameters like entry/exit points, profit targets, and stop-loss limits. Rigorous backtesting with historical data is crucial before live deployment. This simulates performance, revealing profitability and potential drawdowns. Adjust parameters for optimal market alignment.

Monitoring and Adjustment

Continuous monitoring is paramount post-deployment. Market conditions are dynamic; strategies can quickly become obsolete. Regularly review your bot’s performance and P&L. Adjust parameters or strategies as needed, guided by market news and technical analysis.

In conclusion, crypto trading bots offer a powerful pathway to automate and enhance your cryptocurrency trading activities. By leveraging their speed, efficiency, and emotion-free execution, traders can unlock new levels of market participation and potential profitability. While they require initial setup and ongoing monitoring, the strategic advantages they provide are undeniable in today's fast-paced digital asset landscape. For those ready to elevate their trading strategy, explore what Crypto Sniper Bot has to offer.